The recent volatility has been a blessing for weekly options trades. Coupled with earnings season, there’s enough momentum to justify aggressively playing these short-term vehicles for hefty profits.

First up, Alibaba (BABA)…

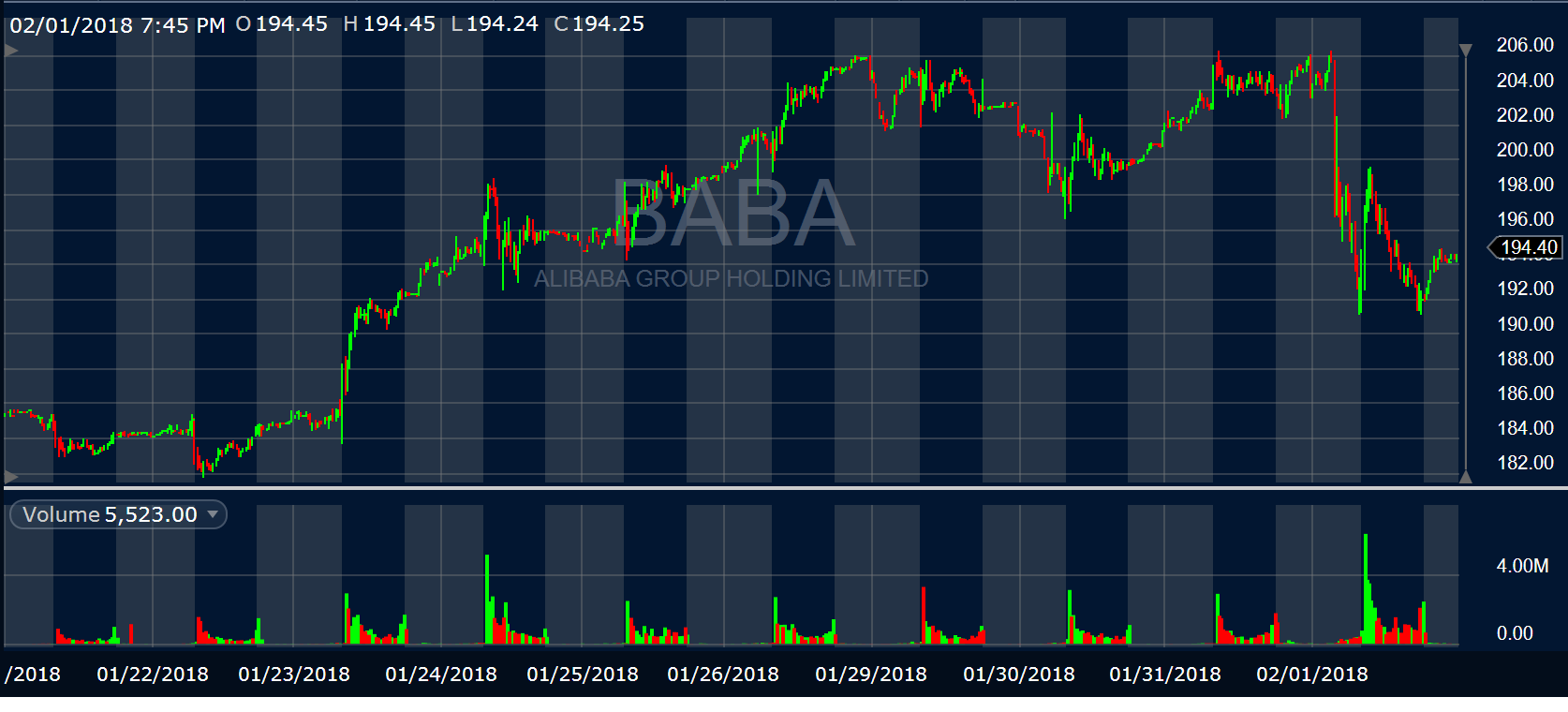

The company reported better than expected earnings this morning but the stock reacted by selling off sharply during premarket trading.

Initially, since this stock as well as many other technology names have been up so much lately, our plan was to short. After seeing the buyers on the tape pressing $194 we chose to buy some $195 weekly calls.

We were able to pick this option up for under $2 and sell it for over $3 after the stock rebounded back over $196. You can see the option hit $5 before losing 80% of it’s value.

These are the dangers of weekly options folks, you have to know when to sell them!

The next trade in Facebook took a bit longer but was equally profitable.

Now, Facebook (FB) also reported earnings last night you can see above the lighter shaded blue area is the overnight session. This stock hasn’t been able to break past the $190 area and you can see they took the stock down to $176 and came all the way back. Some wild rides these earnings you have no idea what you’re going to wake up to.

The fact though that it was able to hold $190 when we started trading this morning at 9:30 gave us a reason to flag this one for a long into all-time highs.

Check out the chatroom action on this one by clicking on the link below and the twitter feed. We all got a nice piece.

$FB today paid out to the Steamroom w/ @WallStJesus. Few of us got into 192.5 calls and the tape just guided the way to a fat exit. Free 3-day trial if you want in on this! https://t.co/yvsRCR7r5v pic.twitter.com/1bTdDznVto

— Sang Lucci™ (@sanglucci) February 1, 2018

Share this Post